Earendil | Letter Of Credit Blog

WHAT IS THE LC

- A letter of credit (LC) is a document sent from a bank or financial institute that guarantees that a seller will receive a buyer's payment on time and for the full amount.

- In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

- Letters of credit are often used within the international trade industry.

- Banks collect a fee for issuing a letter of credit..

REVOCABLE LC/IRREVOCABLE LC

- Revocable LC can be altered at any time by the issuing bank/buyer without informing the seller.

- Whereas, In Irrevocable LC without consent of seller, no alterations can be made to anyone.

WITH OR WITHOUT RECOURSE LC

- A letter of credit with recourse means if the issuing bank refuses to pay to the nominated.

- A letter of credit without recourse means the nominated bank does not have a recourse if the issuing bank fails to make the payment or does not accept the documents.

CONFIRMED LC/ UNCONFIRMED LC

- When the advising bank also guarantees the payment to the beneficiary, it is called confirmed LC.

- Whereas, Unconfirmed LC Only the Bank issuing the LC will be liable for payment of this LC.

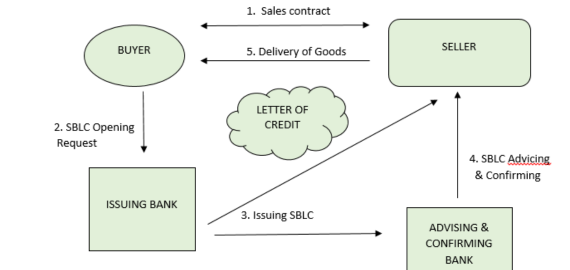

STAND-BY LC

- This LC is closer to the bank guarantee and gives more flexible collaboration opportunity to Seller and Buyer.

- The Bank will honour the LC when the Buyer fails to fulfill payment liabilities to Seller.

TRANSFERABLE LC

- If an LC can be transferred by the beneficiary in whole or in part to a second beneficiary (usually a supplier to the seller) then the LC is a transferable LC.

- The 2nd beneficiary, however, cannot transfer the LC further.

BACK-TO-BACK LC

- Two LCs are issued-one by the bank of buyer to the intermediary & second by the bank of an intermediary to the seller.

RED CLAUSE LC

- The seller can request an advance for an agreed amount of the LC before shipment of goods and submittal of required documents

- This red clause is so termed because it is usually printed in red on the document to draw attention to "advance payment" term of the credit.

DEFERRED PAYMENT LC

- A deferred payment letter of credit, also known as a usance letter of credit, is a commercial letter of credit that provides that the beneficiary will be paid, not at the time the beneficiary makes a complying presentation, but at a later, specified, maturity date.

PAYMENT AT SIGHT LC

- According to this LC, payment is made to the seller immediately (maximum within 7 days) after the required documents have been submitted.